Chapter 4

ISLAMIC BOND

Definition of sukuk

A sukuk is an Islamic financial certificate, similar to a bond in Western finance, that complies with Shariah or Islamic religious law

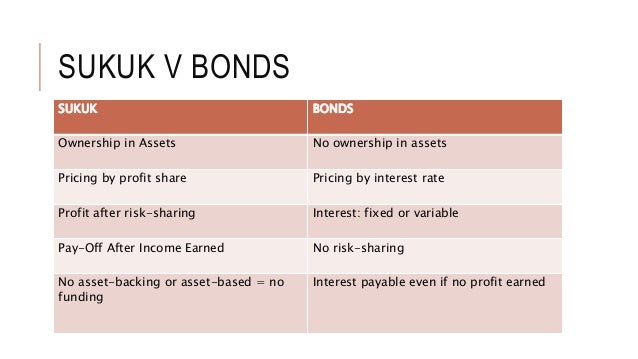

Differences Between Sukuk & Bond

Process of issuance of sukuk

The unique nature of sukuk requires a specific issuing process for the financial instrument. The following steps are common in the issuance process:

- A company that requires capital (referred to as the “originator”) establishes a special purpose vehicle (SPV). The SPV protects the underlying assets from creditors if the originator suffers from financial problems.

- The special purpose vehicle (SPV) issues sukuk certificates that are sold to the investors.

- The originator purchases the requires asset using the proceeds from the sale of the certificates to the investors.

- The SPV buys the asset from the originator.

- The SPV pays the asset sale proceeds to the originator.

- The SPV sets up the lease of the asset to the originator. The originator makes the lease payments to the SPV, which later distribute the payments among the holders as lease income.

- On the termination date of the lease, the originator purchases the asset back from the SPV at its nominal value. The SPV distributes the proceeds to the holders

Type of Sukuk

ASSET BACKED SUKUK

- Asset backed-sukuk involve granting the investor (sukuk holder) a share of a tangible asset or business venture along with a corresponding share of the total risk (that is, a share commensurate with this ownership).

- In this structure, there is a true sale transaction, where the originator sells the underlying assets to a special purpose vehicle (SPV) that holds these assets and issues the sukuk backed by them. The buyers of sukuk don't have recourse to the originator if payments are less than usual.

- A true sale implies that the assets of the issuer will not be added to the assets of the originator in the event of default and liquidation.

ASSET BASED SUKUK

- Asset-based sukuk, on the other hand, involve the issuer purchasing the underlying assets and then investing, trading or leasing them on behalf the investors (sukuk holders), using the funds raised through the issued certificates (sukuk).

- This structure, most often, takes the guise of a sale-lease to the originator and is embedded with a binding promise (wa'ad mulzim) from the originator to repurchase the underlying assets at maturity. In this structure, the sukuk holders can only require the originator to purchase the underlying assets.

- Asset-based sukuk grant only beneficial ownership to the sukuk holders, so that in case of default, the investor would be left without any claim on these assets

Differences between Asset Backed & Asset based Sukuk

Hybrid Sukuk

Hybrid sukuk can be classified into three types, namely:

1. Convertible sukuk: this is a type of sukuk that gives the

holder the right at a future date to convert their sukuk

into new equity shares of the sukuk issuer.

This is done at a specified rate of conversion and under

prescribed conditions. Hence, in other word, a convertible

sukuk is convertible to issuer’s shares.

2. Exchangeable sukuk: this is a type of sukuk that gives the

holder the right at a future date to exchange their sukuk

for existing equity shares of a company apart from the

issuer’s sukuk (usually a subsidiary or a company that the

issuer own shares).

This is done at a specified rate of conversion and under

prescribed conditions. In other word, exchangeable sukuk

is convertible to third party’s shares.

3. Perpetual sukuk: this is a type of sukuk that

incorporates the characteristics of equity

with regular return.

This is done with no predetermined maturity

date and with a call option at the discretion

of the issuer

Sukuk salam

- In a salam contract, an asset is delivered to a buyer on a future date in exchange for full advance spot payment to the seller.

- In salam sukuk, the sukuk holders’ (investors’) funds are used to purchase assets from an obligator in the future. The SPV provides the money to the obligator. This contract requires an agent (which may be a separate underwriter) who will sell the future assets because the investors only want money in return for their investment — not the assets themselves.

- The proceeds from the sale (typically the cost of the assets plus a profit) are returned to the sukuk holders. Salam sukuk are used to support a company’s short-term liquidity requirements.

OVERVIEW OF STRUCTURE

1. Issuer SPV issues sukuk salam certificate to investor.

2. The Investors subscribe for sukuk and pay the proceeds to Issuer SPV. At the

same time, issuer acts as trustee.

3. Originator enters into a sale and purchase arrangement with Trustee,

pursuant to which Originator agrees to sell, and Trustee agrees to purchase,

the Salam Assets from Originator on immediate payment and deferred

delivery terms.

4. Trustee pays the sale price to Originator as consideration for its purchase of

the Salam Assets in an amount equal to the Principal Amount.

5. Originator delivers a proportion of the Salam Assets to Trustee.

6. Originator (as Obligor) purchases the Salam Assets from Trustee for an

agreed Purchase Price.

7. Originator pays the Purchase Price as consideration for purchasing the

Salam Assets.

8. Issuer SPV pays each Periodic Distribution Amount to the Investors using the Purchase Price it has

received from Originator.

9. Originator will be obliged to deliver all of the Salam Assets (which have not yet been delivered) to Trustee and

Trustee will sell, and Originator will buy, the Salam Assets at the applicable Exercise Price which will be equal to

the Principal Amount plus any accrued but unpaid Periodic Distribution Amounts owing to the Investors

10.Payment of Exercise Price by Originator (as Obligor).

11.Issuer SPV pays the Dissolution Amount to the Investors using the Exercise Price it has received from

Originator.

SUKUK AL MUDARABA

- In the Islamic finance industry, the term mudaraba is broadly understood to refer to a form of equity-based partnership arrangement whereby one partner provides capital (the Rab al-Maal) and the other provides managerial skills (the Mudarib).

- Each Investor’s purchase of mudaraba sukuk would represent units of equal value in the mudaraba capital, and are registered in the names of the sukuk certificate holders on the basis of undivided ownership of shares in the mudaraba capital. The returns to the Investors would represent accrued profit from the mudaraba capital at a pre-agreed ratio between the Rab alMaal and the Mudarib, which would then pass to the Investors according to each Investor’s percentage of investments in sukuk mudaraba.

- Examples of recent sukuk al-mudaraba issuances and advised upon by Clifford Chance LLP are:

• SAR1 billion issuance by Purple Island/Bin Laden in November 2008 (no purchase undertaking)

• Abu Dhabi Islamic Bank’s AED2 billion Tier I issuance issued in February 2009 (no purchase

undertaking);

Overview of Structure

1. Issuer SPV issues sukuk mudharabah certificates, which represent an undivided

ownership interest in an underlying asset, transaction or project.

2. The Investors subscribe for sukuk and pay the proceeds to Issuer. Issuer SPV

declares a trust over the proceeds and thereby acts as Trustee on behalf of the

Investors.

3. Issuer SPV and Originator enter into a Mudaraba Agreement with Originator as

Mudarib and Issuer SPV as Rab al- Maal, under which Issuer SPV agrees to

contribute the Principal Amount for the purpose of a Shari’a compliant

Mudaraba enterprise.

4. Originator, as Mudarib under the Mudaraba Agreement, agrees to contribute its

expertise and management skills to the Shari’a compliant Mudaraba enterprise,

with responsibility for managing the Rab al-Maal’s cash contribution in

accordance with specified investment parameters.

Overview of Structure

5. Issuer SPV and Originator enter into the Mudaraba enterprise with the purpose of generating

profit on the Principal Amount.

6. Profits generated by the Mudaraba enterprise are divided between Issuer SPV (as Rab al-Maal)

and Originator (as Mudarib) in accordance with the profit sharing ratios set out in the Mudaraba

Agreement but accrued for the duration of the Mudaraba enterprise

7. In addition to its profit share, Originator (as Mudarib) may be entitled to a performance fee for

providing its expertise and management skills if the profit generated by the Mudaraba enterprise

exceeds a benchmarked return. This performance fee (if any) would be calculated at the end of

the Mudaraba term and upon liquidation of the Mudaraba.

8. Issuer SPV receives the Mudaraba profits and holds them as Trustee on behalf of the Investors.

9. Issuer SPV (as Trustee) pays each periodic return to Investors using the Mudaraba profits it has

received under the Mudaraba Agreement

Sukuk ijarah

- The ijara contract is essentially a rental or lease contract: It establishes the right to use an asset for a fee. The basic idea of ijara sukuk is that the sukuk holders (investors) are the owners of the asset and are entitled to receive a return when that asset is leased.

- In this scenario, the SPV receives the sukuk proceeds from the investors; in return, each investor gets a portion of ownership in the asset to be leased. The SPV buys the title of the asset from the same company that is going to lease the asset. In turn, the company pays a rental fee to the SPV.

OVERVIEW OF STRUCTURE

1. Issuer SPV issues sukuk ijarah certificate, which represent an undivided ownership interest in an

underlying asset or transaction.

2. The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”).

Issuer SPV declares a trust over the proceeds and thereby acts as Trustee on behalf of the

Investors.

3. Originator enters into a sale and purchase arrangement with Trustee, pursuant to which

Originator agrees to sell, and Trustee agrees to purchase, certain assets from Originator.

4. Trustee pays the purchase price to Originator as consideration for its purchase of the Assets in an

amount equal to the Principal Amount.

5. Trustee leases the Assets back to Originator under a lease arrangement (ijara) for a term that

reflects the maturity of the sukuk.

6. Originator (as Lessee) makes Rental payments at regular intervals to Trustee (as Lessor). The

amount of each Rental is equal to the Periodic Distribution Amount payable under the sukuk at

that time.

7. Issuer SPV pays each Periodic Distribution Amount to the Investors using the Rental it has received from

Originator.

8. Trustee will sell the ijarah asset to originator (obligor).

9. Originator will buy-back, the Assets at the applicable Exercise Price, Payment of Exercise Price by

Originator (as Obligor).

10. Issuer SPV pays the Dissolution Amount to the Investors using the Exercise Price it has received from

Originator.

11. Trustee and Originator will enter into a service agency agreement whereby Trustee will appoint Originator

as its Servicing Agent to carry out certain of its obligations under the lease arrangement, namely the

obligation to undertake any major maintenance, insurance (or takaful) and payment of taxes in connection

with the Assets.

12. Originator (as Servicing Agent) claims any costs and expenses for performing these obligations (the

“Servicing Costs”) from trustee.

Sukuk istisna

- Istisna is a contract between a buyer and a manufacturer in which the manufacturer agrees to complete a construction project by a future date. The contract requires a fixed price and product specifications that both parties agree to. If the end product doesn’t meet contract specifications, the buyer can withdraw from the contract.

- Istisna sukuk are based on this type of contract. The sukuk holders are the buyers of the project, and the obligator is the manufacturer. The obligator agrees to manufacture the project in the future and deliver it to the buyer, who (based on a separate ijara contract) will lease the asset to another party for regular payments.

OVERVIEW OF STRUCTURE

1. Issuer SPV issues sukuk istisna certificate, which represent an undivided ownership interest in an

underlying asset or transaction.

2. The Investors subscribe for sukuk and pay the proceeds to Issuer SPV (the “Principal Amount”).

Issuer SPV declares a trust over the proceeds and thereby acts as Trustee on behalf of the

Investors.

3. Originator enters into an istisna arrangement with Trustee, pursuant to which Originator agrees

to manufacture or construct certain assets and undertakes to deliver those Assets at a future

date, and Trustee agrees to commission those Assets for delivery at such future date.

4. Trustee pays a price (typically by way of staged payments against certain milestones) to

Originator as consideration for the Assets in an aggregate amount equal to the Principal Amount.

5. Issuer SPV forward lease of assets to originator (as lessee).

6. Originator (as Lessee) makes payments of: Advance Rental prior to the delivery (i). of the Assets;

and Actual Rental following the delivery (ii). of the Assets.

7. Issuer SPV pays each Periodic Distribution Amount to the Investors using the

Advance Rental or, as the case may be, the Actual Rental it has received from

Originator.

8. Trustee will sell the asset to originator (as obligor).

9. Originator (as obligor) will purchase, the Assets at the applicable Exercise Price,

which will be equal to the Principal Amount Issuer SPV pays the Dissolution

Amount to the Investors using the Exercise Price.

10.Trustee and Originator will enter into a service agency agreement whereby

Trustee will appoint Originator as its Servicing Agent, on and from delivery of the

Assets, to carry out certain of its obligations under the forward lease

arrangement, namely the obligation to undertake any major maintenance,

insurance (or takaful) and payment of taxes in connection with the Assets.

11.Originator (as Servicing Agent) claims any costs and expenses for performing

these obligations (the Servicing Cost) from trustee

1 comments

Good job group 4.chaiyokk.welldone ank muda. I like.

ReplyDelete